Finance automation is no longer a futuristic concept but a practical necessity for businesses aiming to optimize efficiency. With the growing demand for faster and more accurate financial operations, API integrations are leading the charge. This post explores seven powerful finance automation strategies that can transform the way your business handles its financial operations, cutting down on manual tasks and reducing costly mistakes.

We have shared a new blog titled “API Automation for Small Businesses: 7 Proven Best Practices to Scale Efficiently.” In this post, we dive into practical and effective ways for small businesses to leverage API automation to streamline their operations, save time, and scale with efficiency. You can read the full blog and explore these best practices by following this link.

Table of Contents

How API Integrations Drive Finance Automation

In today’s fast-paced financial landscape, API integrations play a pivotal role in finance automation. APIs (Application Programming Interfaces) allow different software systems to communicate and work together seamlessly, automating repetitive tasks such as invoicing, payroll processing, or expense management.

APIs are crucial because they eliminate manual data entry and transfer, reducing the risk of human errors. For example, an API integration between a company’s ERP system and its bank ensures real-time updates of transactions without needing manual uploads. But beyond just data transfers, APIs can automate entire workflows in the finance department, freeing teams to focus on strategic decisions rather than operational processes.

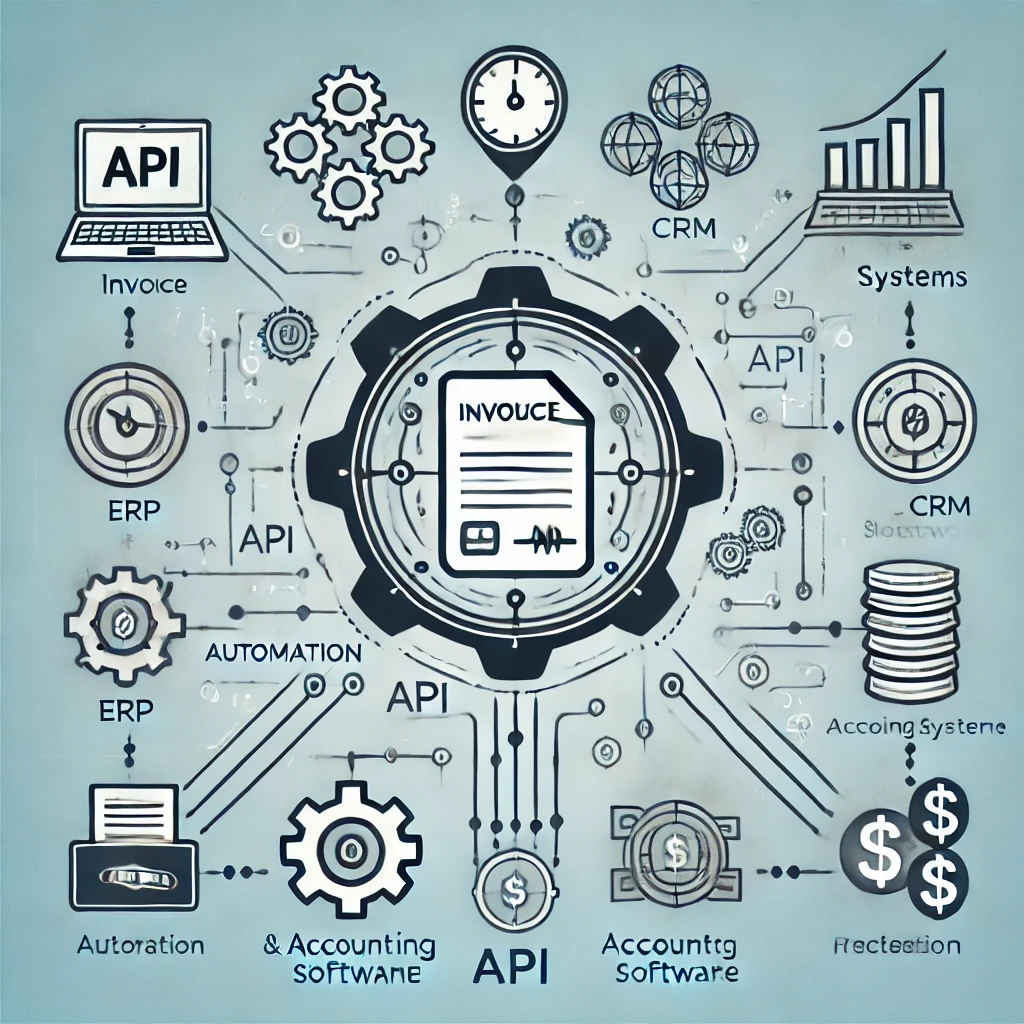

1. Automated Invoicing with API Integration

Invoicing is often a highly time-consuming task in finance, especially for businesses handling multiple transactions daily. Mistakes in invoicing, such as errors in amounts, incorrect client details, or delayed issuance, can lead to significant financial losses or delayed payments. However, automating invoicing through API integration significantly enhances both speed and accuracy.

By connecting invoicing software with ERP, CRM, or accounting systems, the entire process becomes automated. As soon as a service is provided or a product is delivered, invoices are generated automatically, with all relevant details seamlessly pulled from linked systems. This ensures that no manual input is required, drastically reducing the potential for errors and freeing up valuable time for the finance team to focus on higher-level tasks. The accuracy of automation ensures that invoices are correct the first time, while the speed of API-driven integration accelerates payment cycles.

For instance, tools like QuickBooks and Xero offer powerful API integrations that automatically sync your invoices with customer data and payment systems. This eliminates manual input, ensuring that invoices are always accurate, sent on time, and can be tracked easily.

Benefits of Automating Invoicing:

- Reduces manual data entry, saving hours every week.

- Minimizes errors in billing and improves cash flow.

- Automatically tracks paid and unpaid invoices, allowing for easier follow-up.

Illustration idea: An infographic showing the flow from service delivery to invoice generation via API integration.

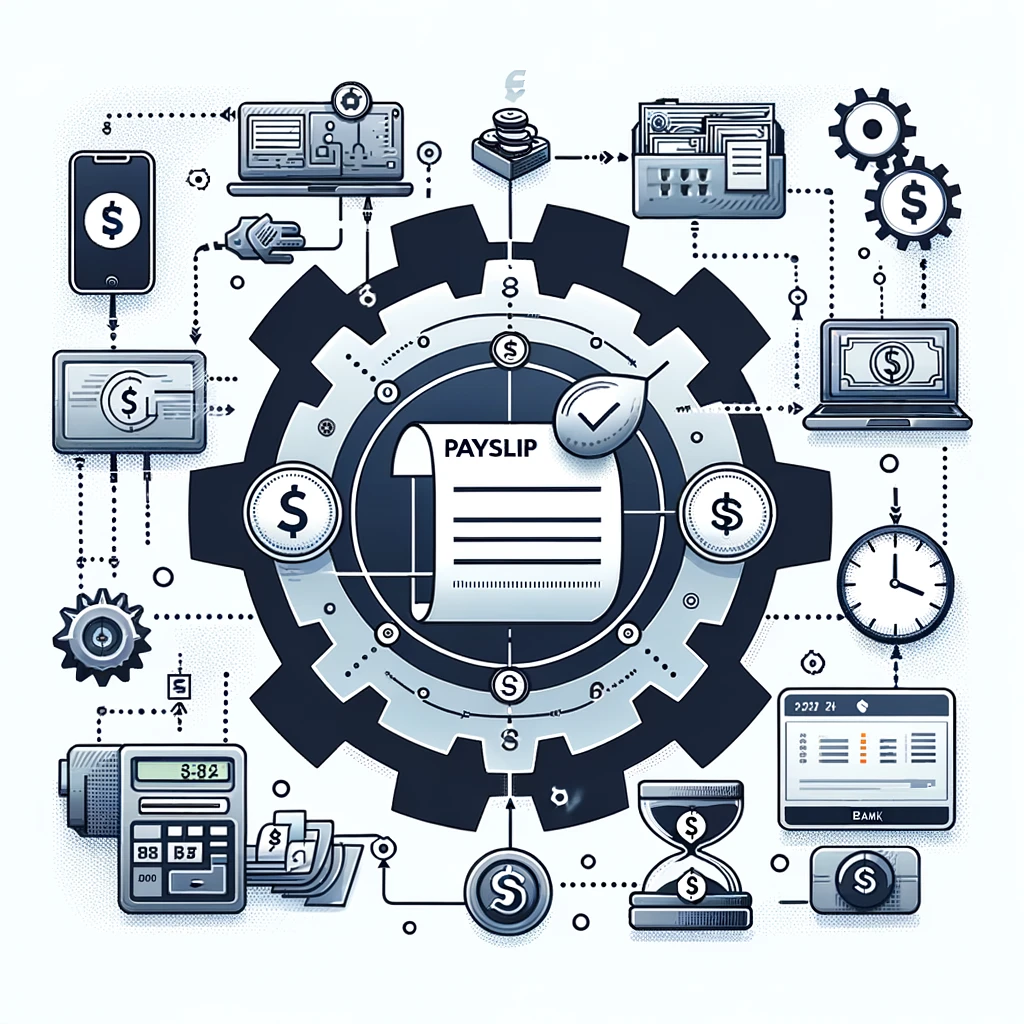

2. Payroll Automation: Pay Employees Efficiently

Finance automation is a game-changer when it comes to optimizing payroll processes, significantly reducing the time and effort involved. Payroll is not only a routine task but also a critical component of a business’s operations, one where even small errors can lead to big consequences such as compliance issues or employee dissatisfaction. Manual payroll processing is prone to errors in calculations, misapplication of tax rates, or even incorrect deductions, all of which can create complications and inefficiencies. Additionally, the manual approach consumes a significant amount of resources, from data entry to verification and auditing.

However, through finance automation powered by API integrations, businesses can connect their payroll systems directly with employee management software, time-tracking tools, and financial institutions, creating a seamless process. This automation allows for the real-time collection of employee work hours, automatic calculations of salaries, taxes, and benefits, and the direct deposit of wages into employee accounts. With finance automation, tasks such as generating payslips, processing deductions, and ensuring compliance with tax regulations become fully automated, reducing the administrative burden and the risk of human error.

Moreover, finance automation in payroll ensures that payments are always processed on time, which not only improves employee satisfaction but also enhances the overall efficiency of the business. Automation also provides real-time reporting and analytics, allowing businesses to easily track payroll expenses, forecast future costs, and maintain better control over their financial operations. The integration of payroll with other financial systems means that data flows smoothly across departments, enabling more accurate budgeting and financial planning.

In short, finance automation in payroll processing allows businesses to streamline their operations, enhance accuracy, reduce labor costs, and ensure compliance, all while freeing up time for more strategic tasks. This type of automation is no longer a luxury but a necessity for businesses looking to scale efficiently and maintain operational excellence.

For example, integrating Gusto or ADP with a time-tracking software or HR system through APIs ensures that the payroll process runs smoothly, and employees are paid accurately and on time.

Advantages of Payroll Automation:

- Reduces payroll processing time from hours to minutes.

- Ensures compliance with tax regulations and benefits deductions.

- Provides detailed, up-to-date payroll reports for financial oversight.

Illustration idea: A simple diagram showing how employee time records are automatically converted into paychecks via payroll automation.

3. Expense Management: Control Spending with Seamless API Integrations

Finance automation plays a crucial role in simplifying the complex task of managing employee expenses, especially for businesses with a large number of traveling staff. Without automation, tracking expenses can be a logistical nightmare, requiring employees to manually submit receipts and accounting teams to review each one individually. This manual process is not only time-consuming but also prone to errors, delays, and inefficiencies. For companies with numerous traveling employees, these inefficiencies can quickly compound, leading to missed reimbursements, inaccurate expense reporting, and potential compliance issues.

By implementing finance automation, particularly through API integrations, businesses can significantly streamline their expense management processes. With automated systems, employee credit card transactions, receipts, and reimbursement requests are synced directly into the company’s accounting software. This eliminates the need for manual data entry and review, drastically reducing the chances of errors. For example, employees can use expense management apps that automatically capture and categorize their expenses, and through API integrations, these expenses are transferred directly into the company’s financial systems.

Finance automation in expense management also provides real-time visibility into company spending, allowing finance teams to track and manage expenses more effectively. With automated approvals, notifications, and real-time tracking, finance departments can ensure that expense reports are processed quickly, and employees are reimbursed without delays. Additionally, by automating these processes, companies can ensure compliance with internal policies and external regulations, as the system can flag any out-of-policy expenses automatically.

The benefits of finance automation for expense management go beyond just time savings. It also improves accuracy, enhances employee satisfaction by speeding up reimbursement processes, and offers greater control over company spending. By integrating these automated systems into their workflows, businesses can reduce administrative burdens and focus more on strategic financial management rather than getting bogged down by manual processes. This makes finance automation a critical tool for businesses looking to streamline their operations and scale efficiently.

For example, platforms like Expensify and Concur offer APIs that integrate with accounting systems like QuickBooks or SAP, ensuring that expense reports are generated instantly as transactions occur.

How API-Based Expense Automation Helps:

- Eliminates the need for manual receipt tracking and submission.

- Speeds up reimbursement cycles.

- Provides real-time insights into company spending patterns.

Illustration idea: A chart showing how an employee’s business trip expenses are automatically logged and reimbursed through integrated finance systems.

4. Streamlining Tax Filing and Compliance

Finance automation is especially critical when it comes to tax compliance, an area where even the smallest error can lead to significant penalties or costly audits. Tax regulations are constantly evolving, and staying compliant requires businesses to stay on top of these changes, which can be a daunting and time-consuming task. Managing tax filings manually not only increases the risk of errors but also consumes valuable resources that could be better allocated to other business activities.

By leveraging finance automation, particularly through API integrations, businesses can streamline their tax compliance processes and significantly reduce the potential for mistakes. Automating tax filings through APIs allows companies to integrate their accounting software directly with tax filing systems. This integration ensures that key financial data, such as sales, expenses, and payroll, is automatically calculated and fed into tax forms, drastically reducing the likelihood of manual errors. For example, API integrations with platforms like Avalara can automatically track and update tax rates across different jurisdictions, ensuring that businesses remain compliant with local and federal regulations.

With finance automation, the process of calculating, filing, and paying taxes becomes seamless. As a result, businesses no longer have to worry about manually inputting numbers, missing deadlines, or misapplying tax rates. Automated systems can also provide real-time updates and alerts about upcoming filing deadlines, reducing the stress of tax season and ensuring timely submissions. Moreover, automating tax compliance helps businesses adapt quickly to regulatory changes, as APIs can pull in updated rules and rates without requiring manual intervention.

Finance automation in tax compliance not only saves time and reduces the risk of costly mistakes but also provides businesses with greater peace of mind. With accurate, real-time data at their fingertips, finance teams can confidently manage their tax obligations, ensuring they remain compliant while freeing up resources to focus on other areas of the business. In an era of increasing regulatory complexity, finance automation is essential for businesses looking to stay compliant, avoid penalties, and operate efficiently.

Tools like Avalara offer API integrations that automatically track tax rates across jurisdictions, calculate liabilities, and file returns on time. For businesses with operations in multiple regions, this level of automation ensures compliance without overburdening the finance team.

Key Benefits of Automated Tax Filing:

- Reduces the risk of filing errors or missed deadlines.

- Automatically updates with the latest tax rules and rates.

- Saves time by automating quarterly and annual tax submissions.

Illustration idea: A flowchart showing how tax rates are fetched, calculated, and filed automatically through API-driven systems.

5. Cash Flow Management: Real-Time Insights with API Integrations

Maintaining a healthy cash flow is crucial for any business, as it ensures the company can meet its financial obligations and continue operating smoothly. However, manual tracking and forecasting of cash flow often result in blind spots, making it difficult to anticipate shortfalls or identify areas for improvement. Human error, delayed data entry, and lack of real-time information can lead to inaccurate financial insights, ultimately affecting a company’s decision-making process.

With finance automation, specifically API-driven automation, businesses can achieve real-time cash flow management. By connecting your accounting system directly with banks, credit institutions, and payment processors, financial data flows seamlessly into the system without manual input. This not only speeds up the process but also eliminates the errors associated with manual tracking. Through API integrations, businesses can gain instant visibility into account balances, incoming and outgoing payments, and transaction histories.

Finance automation provides an ongoing, real-time picture of the company’s cash position, allowing finance teams to act quickly when needed, whether it’s adjusting payment schedules, optimizing spending, or taking proactive steps to secure additional funds. Moreover, real-time cash flow monitoring with API integration also aids in more accurate forecasting, helping businesses anticipate future financial needs and make informed strategic decisions.

By automating cash flow management, businesses can ensure they always have a clear and accurate picture of their financial health, leading to better cash management practices and stronger financial stability.

By automating cash flow monitoring, businesses can gain instant insights into account balances, pending payments, and financial forecasts. Solutions like Plaid or Yodlee provide APIs that pull real-time transaction data from financial institutions directly into cash flow management tools.

How Cash Flow Automation Improves Efficiency:

- Provides real-time updates on cash positions.

- Automates reconciliation of payments and deposits.

- Improves decision-making by offering predictive cash flow analytics.

Illustration idea: A dashboard showing real-time cash flow metrics, with updates coming directly from integrated bank APIs.

6. Integrating Payment Gateways: Automate Customer Transactions

Payment processing is a critical area where finance automation can have a profound impact on reducing manual effort and improving overall efficiency. Managing payments manually not only consumes time but also increases the risk of errors, such as missed payments, duplicate entries, or delayed processing. As businesses scale, these challenges grow exponentially, making manual payment handling unsustainable.

By integrating payment gateways directly into your ERP or accounting systems through APIs, you can automate key aspects of the payment process. This automation ensures that customer payments are tracked in real time, reducing the need for manual reconciliation and follow-up. API integrations allow payment gateways such as Stripe, PayPal, or Square to automatically sync payment data with your financial systems, ensuring seamless and accurate records.

With finance automation, businesses can also reduce the number of failed transactions. Automated systems can flag and retry failed payments, reducing the need for manual intervention and improving the success rate of transactions. This also enhances the customer experience, as they encounter fewer issues during the payment process, leading to higher satisfaction and retention.

Additionally, automating payment processes through API integrations helps streamline the overall payment flow. Businesses can easily manage recurring payments, refunds, and chargebacks with minimal manual effort, allowing finance teams to focus on higher-value tasks. By reducing manual effort and ensuring that payments are processed efficiently, finance automation can enhance cash flow management, improve accuracy, and reduce operational costs associated with payment handling.

Platforms like Stripe, PayPal, and Square offer APIs that businesses can use to manage everything from recurring payments to refunds and chargebacks. These integrations allow for smoother financial transactions and better customer experience.

Why Payment Gateway Automation Matters:

- Automates recurring billing and subscription management.

- Reduces the risk of failed transactions or payment delays.

- Provides real-time updates on payment status for easy reconciliation.

Illustration idea: A visual showing how payments from customers are automatically processed and recorded via API-connected payment gateways.

7. Forecasting and Reporting: Drive Data-Driven Financial Decisions

Financial forecasting is a cornerstone of effective business planning, providing insight into future financial performance and helping businesses prepare for growth, potential challenges, and opportunities. However, manually gathering and analyzing financial data from various sources, such as accounting systems, CRM platforms, and sales reports, can be an incredibly time-consuming and error-prone task. This traditional approach often results in delayed or incomplete forecasts, which can limit a company’s ability to make timely and strategic decisions.

By adopting finance automation through API integrations, businesses can automate the data collection process, ensuring that all relevant financial information is continuously and accurately updated. API integrations enable seamless connections between your accounting software, CRM, sales platforms, and other data sources. This allows for the automatic collection and synchronization of financial data, providing a comprehensive and real-time view of your business’s financial health.

With finance automation, financial forecasting becomes more dynamic and reliable. Instead of spending hours or even days manually compiling data, businesses can rely on automated systems to deliver up-to-date reports at the click of a button. This not only saves time but also ensures greater accuracy by reducing the risk of human error. Furthermore, automated systems can analyze trends, generate predictive models, and provide valuable insights into future revenue, expenses, and cash flow.

The integration of finance automation in forecasting enables businesses to make more informed, data-driven decisions. By having a holistic and real-time understanding of their financial performance, companies can identify potential risks, optimize resource allocation, and strategically plan for growth. In today’s fast-paced business environment, the ability to quickly and accurately forecast financial performance is crucial for maintaining a competitive edge, and finance automation is the key to achieving this.

Tools like Fathom or Jirav use APIs to pull in data from multiple sources, providing detailed financial reports and forecasts without manual intervention. This helps finance teams make better data-driven decisions quickly.

Benefits of Automating Financial Reporting:

- Provides accurate, real-time reports with minimal effort.

- Enables predictive financial modeling and scenario analysis.

- Saves significant time spent on manual data entry and report generation.

One Comment